Understanding Tax Brackets

Introduction

Navigating the world of taxes can be daunting, especially when it comes to understanding tax brackets. These brackets are a fundamental part of determining how much individuals owe in taxes each year. By gaining a clear picture of how tax brackets work, taxpayers can make informed financial decisions.

Advertisement

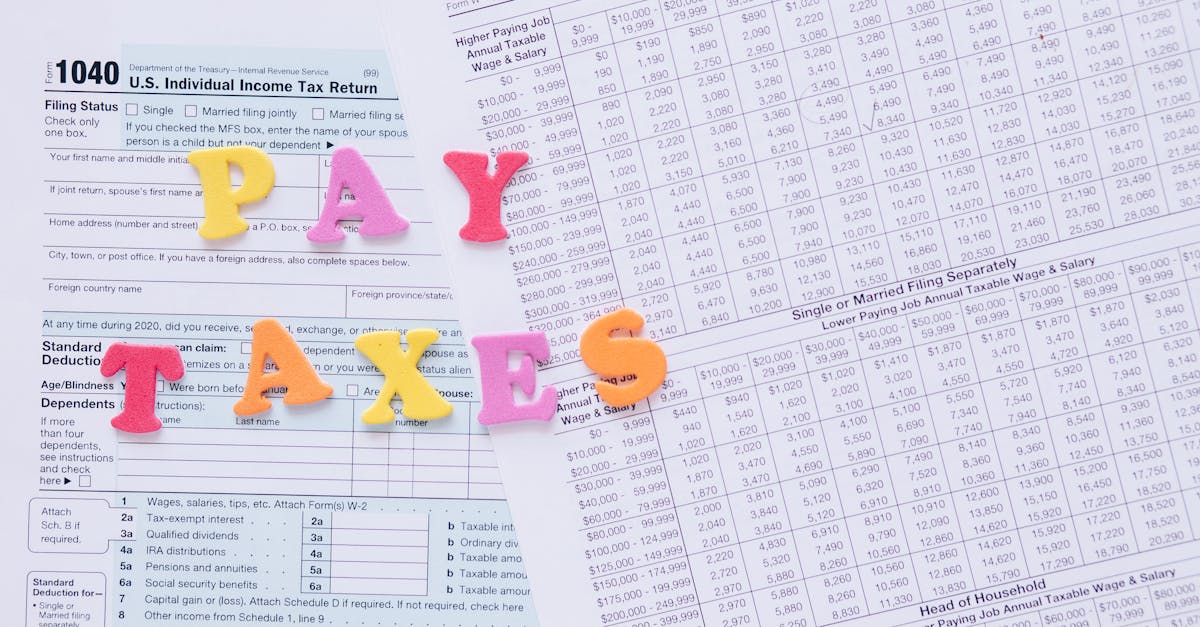

What Are Tax Brackets?

Tax brackets refer to income ranges that are taxed at varying rates. As a progressive tax system, the United States taxes higher income earners at escalating rates, meaning income is divided into sections or "brackets" each taxed at different rates. This system is designed to ensure fairness, meaning those with higher earnings contribute more to public revenue.

Advertisement

Progressive Tax System Explained

In a progressive tax system, the tax rate increases as taxable amounts increase. For example, an individual earning $40,000 might pay a lower tax rate on the first $10,000 and a higher rate on income over that amount. This structure helps distribute the tax burden more equitably across different income levels by requiring higher contributions from wealthier individuals.

Advertisement

How Taxable Income is Calculated

Before placing your income into a bracket, it's important to determine your taxable income. This involves subtracting deductions, exemptions, and adjustments to income from your total earnings. The resulting figure is what will be taxed according to the prevailing rates outlined in the tax brackets.

Advertisement

Marginal vs. Effective Tax Rate

Understanding the difference between marginal and effective tax rates is crucial. The marginal tax rate represents the highest rate applied to the last dollar you earn, while the effective tax rate is the average rate across your entire income. Knowing both rates can help provide a clearer understanding of your tax obligations.

Advertisement

Federal and State Tax Brackets

While federal tax brackets apply across the country, state tax brackets vary significantly. Some states have a flat tax rate, while others follow the progressive model. Therefore, it's essential to investigate both federal and state tax obligations to accurately estimate your total tax liability.

Advertisement

The Role of Deductions and Credits

Strategic use of deductions and credits can significantly affect the tax bracket your income falls into. Deductions lower your taxable income, potentially placing you in a lower bracket, while credits directly reduce the amount owed. Understanding how these tools interact with tax brackets can optimize your tax strategy.

Advertisement

Inflation and Tax Brackets

Inflation adjustments ensure tax brackets remain fair even as the purchasing power of money changes. Each year, many governments adjust income thresholds for inflation, helping prevent "bracket creep," where people could unintentionally be pushed into higher tax brackets due to nominal income increases, not actual earning power.

Advertisement

Tax Planning Strategies

Proactive tax planning can mitigate liabilities linked to changing brackets. This includes strategic financial planning, understanding potential deductions, and timing income and expenses. By recognizing how tax brackets influence financial obligations, individuals can make choices that optimize their fiscal health.

Advertisement

Conclusion

Tax brackets shape how individuals contribute to the nation's revenue. Grasping their implications can empower taxpayers to make judicious financial decisions. By understanding and engaging with these brackets, individuals ensure they meet their obligations while maximizing potential benefits.

Advertisement