Exploring Top Savings Accounts in 2024

Introduction

In the realm of personal finance, choosing the right savings account is crucial for meeting future financial goals. As we venture into 2024, financial institutions are offering a variety of savings accounts to cater to the diverse needs of customers. Understanding these options will help you secure your financial future efficiently.

Advertisement

Understanding Savings Accounts

Savings accounts are a cornerstone of everyday banking, providing a safe yet accessible avenue for storing and growing your funds. They typically offer interest, albeit modest, while ensuring liquidity. The diversity of account types allows consumers to choose based on interest rates, fees, and other features.

Advertisement

High-Yield Savings Accounts

One of the most attractive options in 2024 is the high-yield savings account, which provides a superior interest rate compared to traditional accounts. These accounts are particularly appealing because they offer returns that can effectively combat inflation, although they may require a higher minimum balance.

Advertisement

Online vs. Traditional Banks

The battle between online banks and bricks-and-mortar institutions continues to impact the savings account landscape. Many online banks offer competitive interest rates with lower fees due to reduced overhead costs. On the other hand, traditional banks provide the benefit of in-person services, which some customers may prefer.

Advertisement

Considerations for Choosing an Account

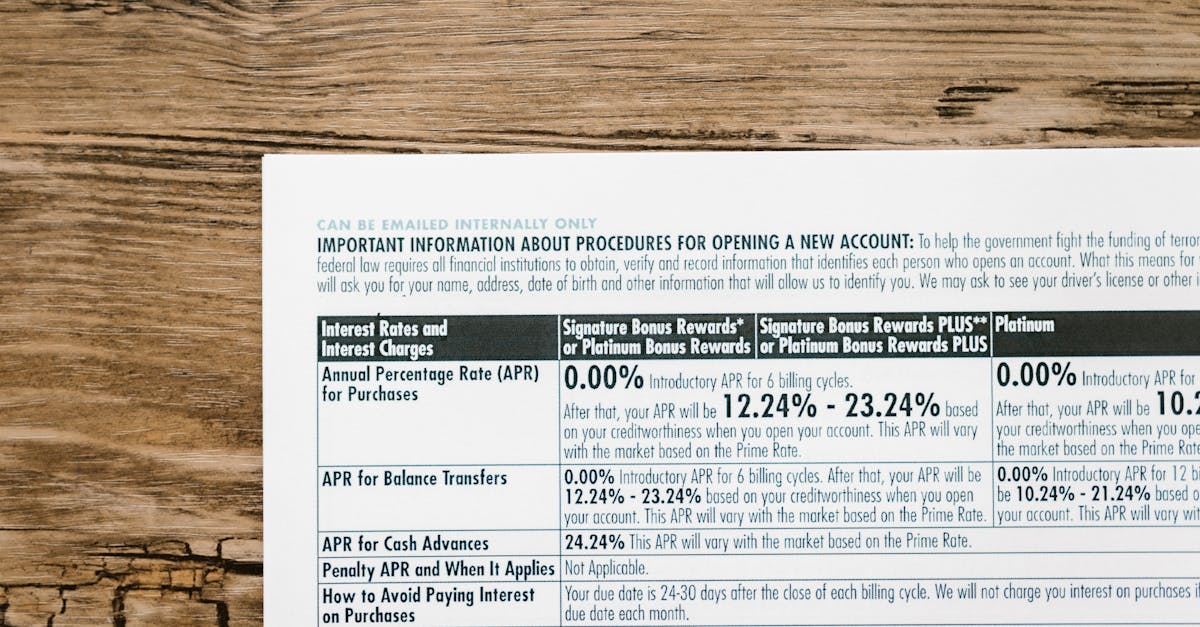

When evaluating savings accounts, several factors come into play. Key considerations include interest rates, fees, minimum balance requirements, and account access. Evaluating these elements against your personal financial goals and lifestyle is essential for making an informed choice.

Advertisement

Fees and Charges

Fees can significantly impact the actual return on your savings, so careful scrutiny is advisable. Accounts with high interest may have hidden costs such as maintenance fees, transaction charges, or penalties for dipping below the minimum balance. Always read the fine print to ensure you understand the fee structure.

Advertisement

Related Benefits and Features

Some savings accounts offer supplementary benefits, such as ATM card access, mobile banking, and auto-transfer facilities. While these features can provide additional convenience and bolster savings habits, they should ideally align with your requirements without additional costs.

Advertisement

Exploring New Features in 2024

Banks are increasingly integrating technological advancements into their offerings. In 2024, innovations such as AI-driven financial analysis tools and sustainability-linked savings options are redefining account features. Keeping abreast of these trends can help you leverage cutting-edge benefits.

Advertisement

Safety and Security

Security remains a crucial concern when selecting a savings account. Ensure that any bank you consider is protected by a reputable insurance body, such as the FDIC in the United States. Such guarantees safeguard your funds, providing peace of mind as you focus on building your wealth.

Advertisement

Conclusion

In conclusion, selecting the best savings account requires balancing interest rates, fees, and features with your financial plans and preferences. Whether you opt for high-yield accounts or online banking solutions, understanding your choices is key to maximizing your investments in 2024. Make informed decisions today for a brighter financial future.

Advertisement