Key Economic Indicators to Watch

Introduction

Understanding key economic indicators is crucial for evaluating the health of an economy. These indicators provide snapshots of economic performance, helping policymakers, investors, and the public make informed decisions. By keeping an eye on them, one can assess potential trends and anticipate future outcomes.

Advertisement

Gross Domestic Product (GDP)

GDP is arguably the most significant indicator of economic health. It measures the total value of goods and services produced within a country over a specific period. A rising GDP suggests economic growth, which can lead to higher employment and income levels. Conversely, a declining GDP might indicate recessionary trends.

Advertisement

Consumer Price Index (CPI)

The CPI tracks changes in the price level of a basket of consumer goods and services, indicating the rate of inflation. When prices rise significantly, it can erode purchasing power, impacting consumer spending. Monitoring CPI helps central banks make informed decisions about monetary policy, influencing interest rates.

Advertisement

Unemployment Rate

This metric measures the percentage of the labor force that is jobless and actively seeking employment. A high unemployment rate can be a sign of economic distress as fewer people have income to spend. However, exceptionally low unemployment can lead to wage inflation as businesses compete for workers.

Advertisement

Interest Rates

Interest rates, set by central banks, influence borrowing costs and consumer spending. Lower rates can stimulate economic activity by making loans cheaper, while higher rates may slow borrowing and spending. Tracking interest rates is essential for businesses and individuals looking to make financial decisions.

Advertisement

Stock Market Indexes

Stock market indexes, like the S&P 500 or Dow Jones Industrial Average, provide insights into investor sentiment and overall economic confidence. Rising indexes often reflect optimism and prospective business profits. Conversely, declining indexes might indicate economic uncertainty or downside risks.

Advertisement

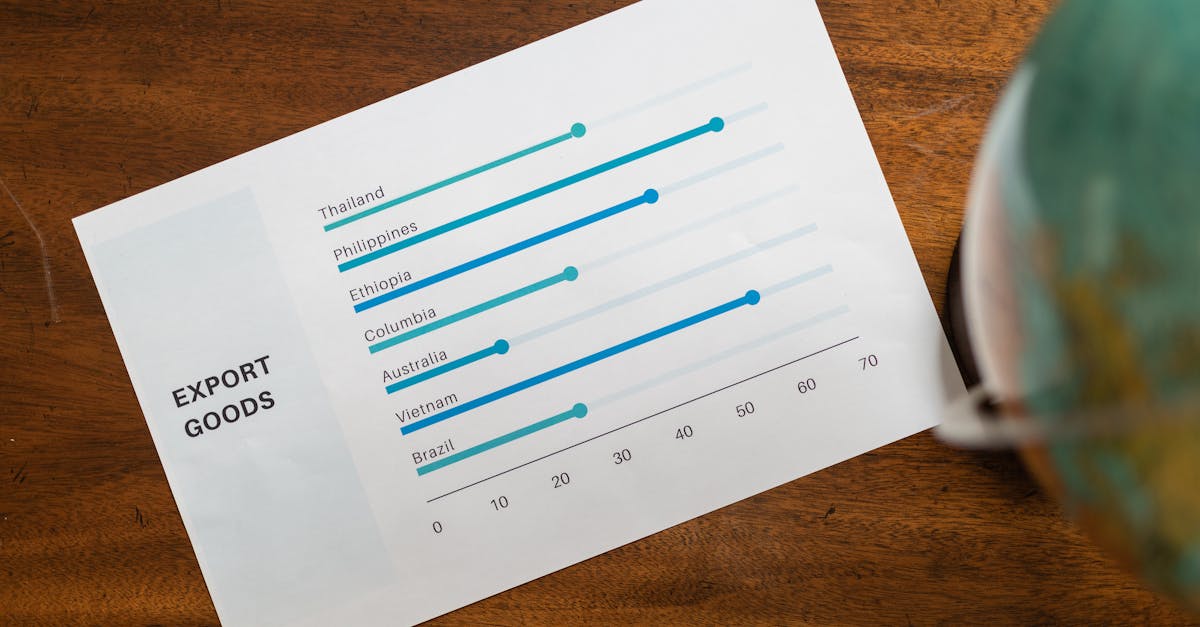

Trade Balance

The trade balance shows the difference between a country's exports and imports. A positive balance suggests that a nation exports more than it imports, contributing to GDP growth. A negative balance can lead to debt accumulation and might affect a country's foreign exchange reserves.

Advertisement

Retail Sales Data

This indicator measures consumer spending on goods, which is a major component of economic activity. Increasing retail sales suggest more robust economic conditions and higher consumer confidence. Declines, on the other hand, might result from economic downturns or changing consumer behaviors.

Advertisement

Housing Market Indicators

Metrics such as housing starts, home sales, and prices indicate the health of the real estate market. A booming housing market can positively impact GDP, create jobs, and foster wealth accumulation. Declines in housing activity might hint at economic slowdowns or financial instability.

Advertisement

Conclusion

In summary, observing key economic indicators like GDP, CPI, and unemployment rates helps understand the economic landscape. These indicators guide policymakers and investors in making strategic choices. Staying informed about these metrics ensures better preparedness for economic shifts.

Advertisement