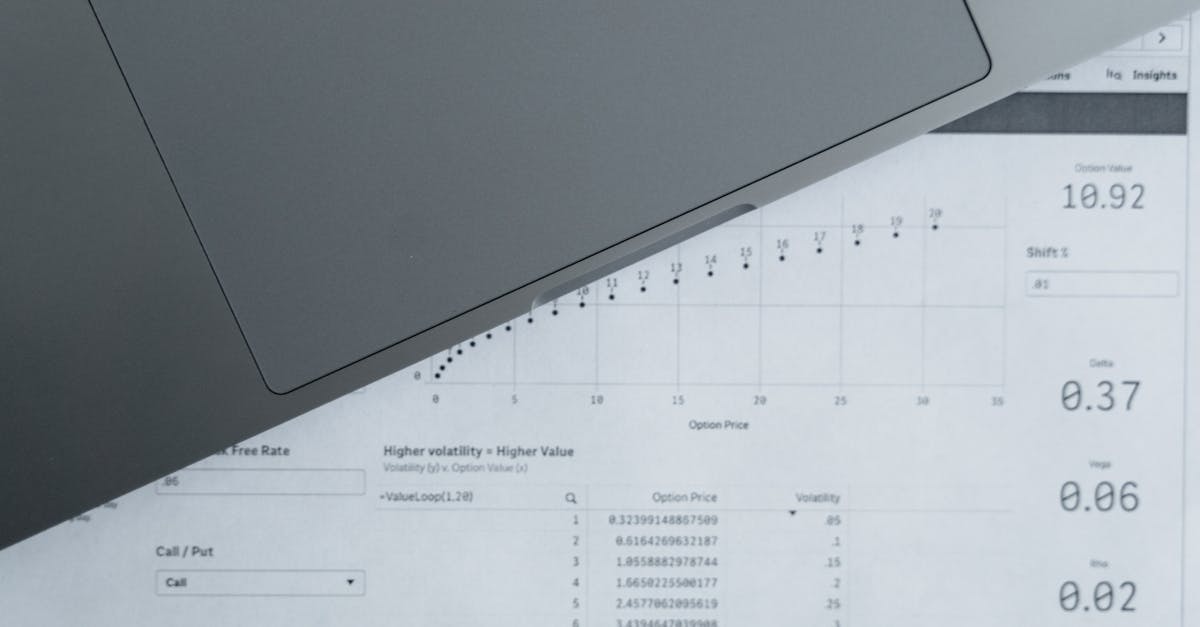

Mastering Financial Ratios for Stock Analysis

Introduction

Stock analysis is an essential skill for investors looking to make informed decisions in the market. Financial ratios are powerful tools that offer deeper insights into a company's financial health. This article will guide you through the key financial ratios you need to analyze stocks effectively.

Advertisement

The Importance of Financial Ratios

Financial ratios help investors compare companies irrespective of their size or industry. They offer a snapshot view of a company's performance by extracting crucial information from financial statements. By understanding financial ratios, investors can assess profitability, liquidity, and solvency, crucial for informed decision-making.

Advertisement

Price to Earnings (P/E) Ratio

The P/E ratio is a foundational tool for evaluating a company's valuation relative to its earnings. Calculated by dividing the current market price by the earnings per share, it helps determine if a stock is overvalued or undervalued. A high P/E suggests the stock might be overpriced, while a low P/E might indicate undervaluation.

Advertisement

Debt to Equity (D/E) Ratio

The D/E ratio measures the financial leverage of a company and assesses its capacity to meet long-term obligations. It is calculated by dividing total liabilities by shareholder equity. A higher ratio indicates higher leverage, which may imply greater risk, while a lower ratio suggests conservative financing and potentially lower risk.

Advertisement

Current Ratio

Liquidity ratios like the current ratio reveal a company’s ability to cover short-term obligations with its assets. Calculated by dividing current assets by current liabilities, a ratio above 1 indicates that the company can meet its short-term debts. It offers investors a glimpse into the company's financial stability in the short run.

Advertisement

Return on Equity (ROE)

ROE measures a company's ability to generate profits from its shareholders' equity. It is calculated by dividing net income by shareholder equity. A higher ROE signals efficient management and profitability, making it a key indicator when comparing companies within the same industry.

Advertisement

Gross Margin Ratio

This ratio shows the percentage of revenue exceeding the cost of goods sold, representing the proportion of money left for expenses and profits. Calculated by subtracting COGS from revenue and dividing by revenue, a high gross margin ratio often indicates efficient production processes and strong pricing power.

Advertisement

Inventory Turnover Ratio

Inventory turnover ratio evaluates how efficiently a company manages its stock. It is calculated by dividing COGS by average inventory. A higher ratio suggests effective inventory management and a strong sales volume, while a lower ratio may point to overstocking or weak sales.

Advertisement

Limitations of Financial Ratios

While financial ratios provide valuable insights, they have limitations. They are based only on historical data and may not reflect future performance. Industry-specific ratios might not translate well across different sectors, and the accuracy of financial ratios depends on the integrity of financial statements.

Advertisement

Conclusion

Understanding and applying financial ratios is crucial for successful stock analysis, granting deeper insights into a company's operational and financial stability. While they have certain limitations, detailing potential risks, they remain indispensable tools for investors. Incorporate these ratios into your strategy to make well-informed investment decisions.

Advertisement