Understanding Tax Brackets Impact

Introduction

Understanding how tax brackets affect your income is essential for financial planning. Tax brackets determine the rate at which your income is taxed, affecting your take-home pay. This article will guide you through the basics of tax brackets and their impact on your earnings.

Advertisement

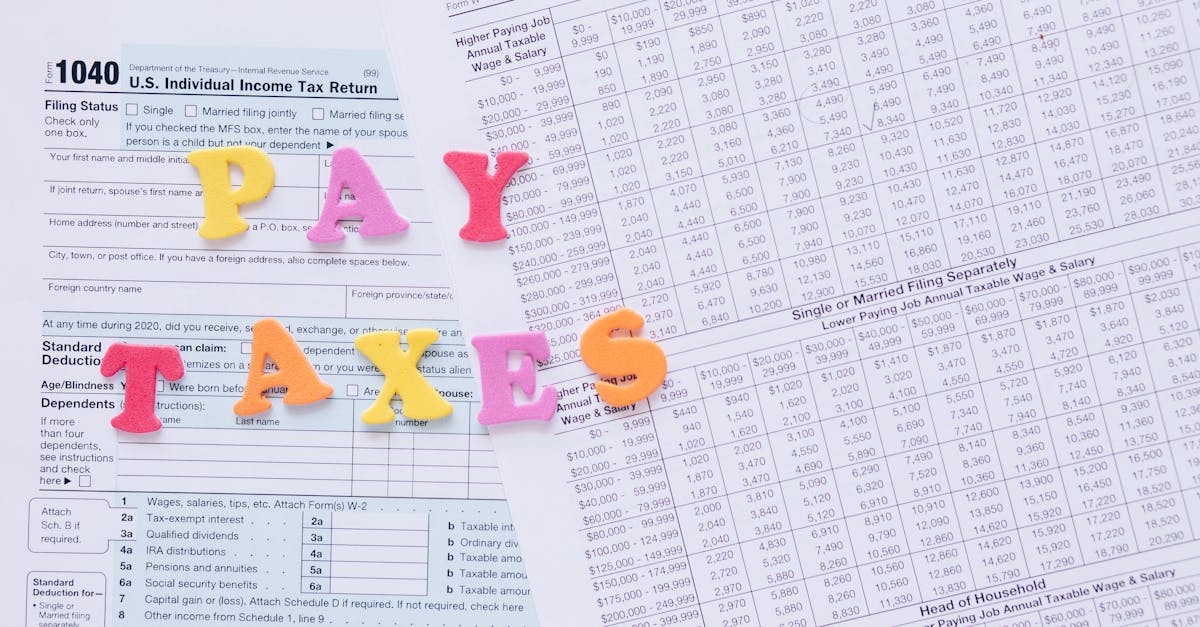

What are Tax Brackets?

Tax brackets are a method used by the government to establish taxation rates based on income levels. These brackets divide income into ranges, where each range is taxed at a specific rate. It's a graduated tax system ensuring individuals with higher incomes pay a larger percentage in taxes.

Advertisement

Graduated Tax System

Unlike a flat tax, where everyone pays the same rate, the graduated system targets income variability. Those earning more are placed into higher tax brackets. However, it's important to note that not all income is taxed at the highest rate – each portion of your income is taxed according to the bracket it falls into.

Advertisement

Impact on Different Income Levels

Your position within a tax bracket affects the percentage of taxes levied on your earnings. Low-income earners might pay a minimal rate, while those surpassing certain thresholds see incremented rates. This progression reduces the tax burden on lower incomes and shifts it proportionally as earnings grow.

Advertisement

Calculating Your Tax Due

To calculate taxes owed, determine your total taxable income. This includes wages, bonuses, and interest, minus deductions or exemptions. Apply each portion of your income to its corresponding bracket rate. This layered taxation approach benefits individuals through available deductions within the system.

Advertisement

Progressive Tax Benefits

The progressive nature of tax brackets aims to distribute tax responsibilities fairly among individuals. By taxing higher earners at a greater rate, the system inherently redistributes wealth, supporting public services and infrastructure, which benefits society as a whole.

Advertisement

Understanding Marginal vs. Effective Tax Rates

The marginal rate refers to the highest tax rate that applies to your last dollar of income, while the effective rate is your total tax paid divided by your total income. Understanding the distinction between these rates is crucial for individuals planning for future growth or deductions.

Advertisement

Strategies to Minimize Tax Burden

Several strategies exist to lower your taxable income, such as contributing to retirement accounts or claiming all eligible deductions. These tactics help you navigate through tax brackets more efficiently, potentially leading to a more advantageous effective tax rate.

Advertisement

Impact on Net Income

The intersection of tax brackets with your income can significantly affect your net income, which is what you take home after taxes. A comprehensive understanding allows for better financial management and planning, ensuring that anticipations for savings or expenditures align with net income forecasts.

Advertisement

Conclusion

Tax brackets play a vital role in shaping how much of your income goes to taxes. Grasping the system's nuances ensures efficient financial planning. Implementing strategies to minimize tax burdens can lead to greater financial health and stability.

Advertisement