Unmasking Hidden Fees in Investment Portfolios

Introduction

Investing in portfolios is a common way to grow wealth, but not all costs are immediately visible. Many investors remain unaware of hidden fees nestled within their investments. Understanding these fees can significantly impact your financial returns.

Advertisement

The Nature of Hidden Fees

Hidden fees are often subtle costs embedded in the fine print of investment contracts. These charges can have a sizable effect on your returns over time. They are not typically highlighted, making them easy to overlook unless scrutinized closely.

Advertisement

Common Types of Hidden Fees

Investment portfolios often carry fees such as management fees, transaction fees, front-load and back-load fees. These can quickly add up and erode returns, making it essential for investors to understand and identify them clearly.

Advertisement

Management and Advisory Fees

Management fees, usually expressed as a percentage of assets under management, compensate the portfolio manager. Although these fees might seem small, they can accumulate, significantly impacting long-term return.

Advertisement

Trading and Transaction Costs

Each transaction within a portfolio may incur costs, take shape as brokerage fees or bid-ask spreads. Regular trading can inadvertently rack up these fees, reducing overall profit margins.

Advertisement

Understanding Fund Expense Ratios

Mutual funds and ETFs have an associated expense ratio, a measure of total fund costs taken from the assets each year. While not hidden, they are often underestimated in their impact on the net return.

Advertisement

The Impact of Load Fees

Load fees are commissions paid to brokers when buying or selling mutual funds. These are often labeled as front-end (charged upon purchase) or back-end (charged upon sale), influencing the overall profitability of an investment.

Advertisement

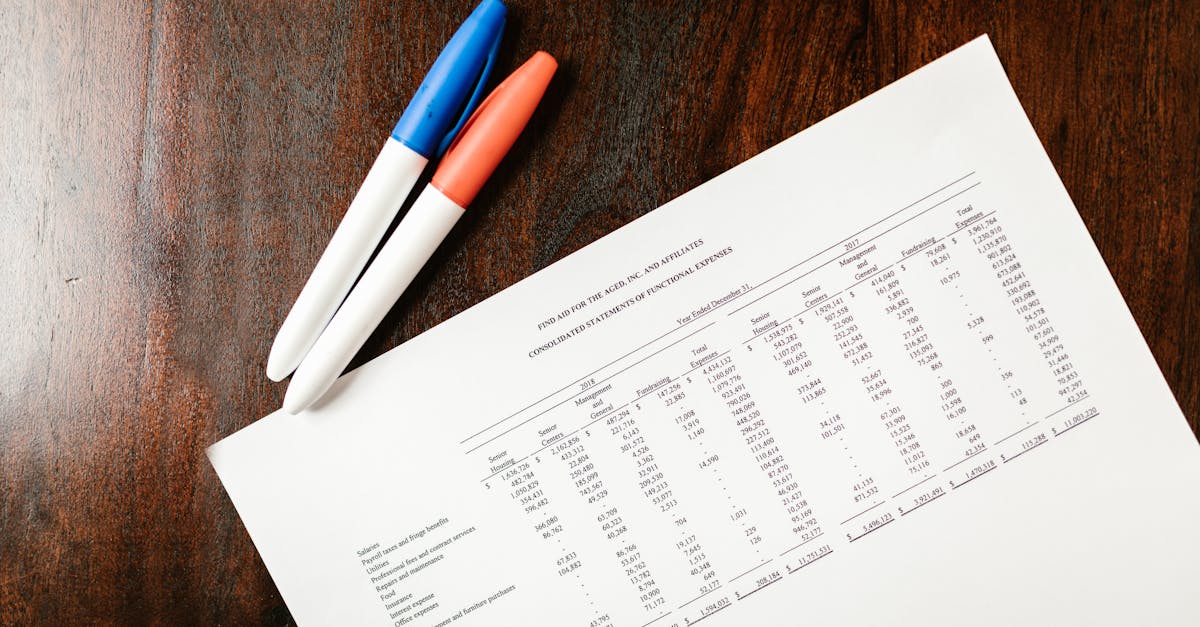

In-depth Examination of Fee Statements

Regularly reviewing quarterly statements can reveal hidden charges that affect your investment’s net performance. Professional advisors are equipped to break down and explain these fees to investors.

Advertisement

Strategies to Minimize Hidden Fees

To manage hidden fees, investors should compare portfolios and opt for low-fee funds. Negotiating with firms for lower advisory rates and minimizing the frequency of trades can also lessen the burden of hidden costs.

Advertisement

Conclusion

Awareness and diligence are key to spotting and mitigating hidden fees in investments. By regularly reviewing portfolio statements and understanding potential charges, investors can safeguard their returns. Being informed empowers you to make smart investment choices.

Advertisement