The Importance of Insurance in Financial Planning

Introduction

In the intricate web of financial planning, insurance plays a pivotal role, functioning as a safety net against unexpected events. Insurance strategically protects assets, income, and loved ones, enabling financial security and peace of mind. Understanding how insurance aligns with financial goals is crucial for comprehensive planning.

Advertisement

Protecting Assets

Insurance is designed to protect assets from unforeseen events such as natural disasters, theft, or accidents. Property insurance is particularly important for homeowners, as it shields the investment against damage. This protection ensures that financial stability isn't compromised by sudden expenses, preserving both assets and lifestyle.

Advertisement

Income Protection

Life is unpredictable, and income-generating ability can be affected by illness or injury. Disability insurance safeguards future income streams by replacing a percentage of lost wages. By securing income, individuals maintain their financial obligations, provide for families, and uphold their long-term financial objectives.

Advertisement

Health Insurance

With rising healthcare costs, health insurance plays a crucial role in financial planning. It covers medical expenses and provides access to essential services. By alleviating the financial burden of medical costs, this insurance helps individuals manage unexpected health issues without depleting savings or encountering debt.

Advertisement

Life Insurance

Life insurance serves as a financial safety net for dependents in case of the policyholder's demise. This insurance replaces lost income, pays off debts, and ensures the family maintains its standard of living. By incorporating life insurance into financial planning, long-term family security is prioritized.

Advertisement

Retirement Planning

Integrating insurance into retirement planning is essential for creating a financially secure future. Annuities offer a consistent income stream during retirement, allowing for predictable financial planning. Long-term care insurance protects retirement savings from being depleted due to medical needs, preserving funds.

Advertisement

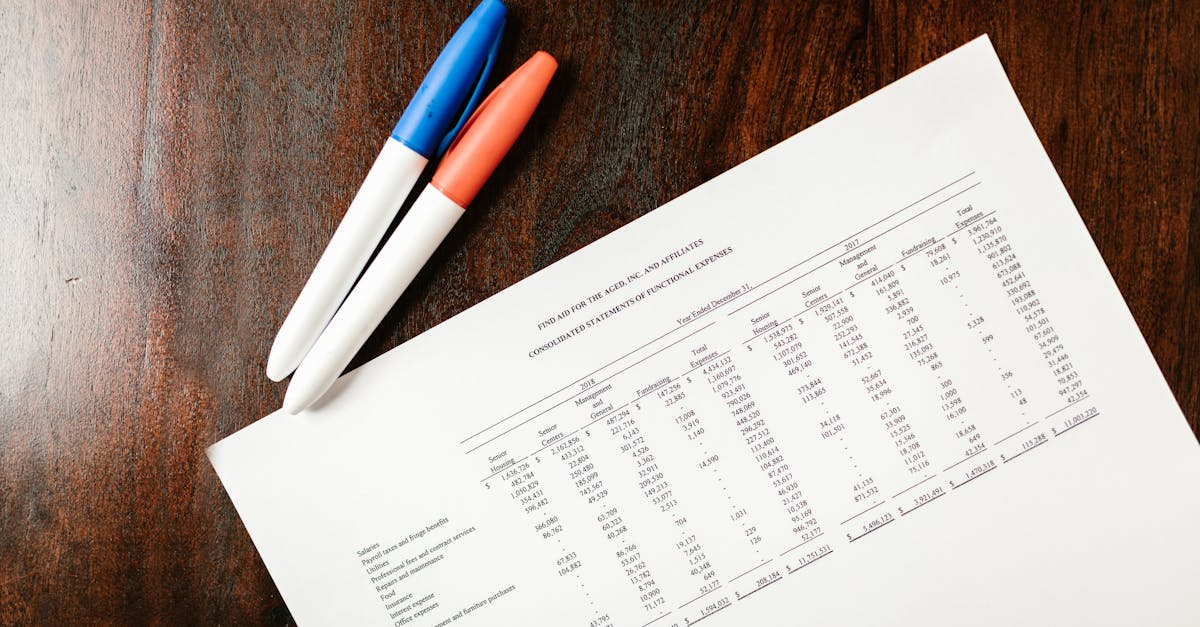

Business Insurance

For entrepreneurs, business insurance is critical in safeguarding operations against risks, including liability, property damage, and financial losses. Benefits of business insurance extend to maintaining operations seamlessly, protecting the owner’s financial interests, and ensuring business continuity despite unforeseen challenges.

Advertisement

Investment Protection

Some insurance products offer both protection and growth opportunities. Variable and indexed life insurance allow policyholders to invest in markets, offering potential gains while safeguarding against losses. These policies diversify income sources and enhance overall wealth-building strategies within the financial plan.

Advertisement

Understanding Policy Selection

Selecting the right insurance policies can be overwhelming, given the myriad of options. Engaging with financial advisors can clarify coverage needs aligning with individual financial goals. Advisors tailor solutions, ensuring policies align strategically within the broader financial plan for maximized benefits.

Advertisement

Conclusion

In conclusion, insurance forms the backbone of a comprehensive financial plan, offering protection and peace of mind. By safeguarding assets, income, and loved ones, insurance enables individuals to focus on achieving financial goals without undue worry. Understanding and integrating insurance into financial planning secures both current stability and future aspirations.

Advertisement