Top Bookkeeping Solutions for Small Businesses

Introduction

In today's competitive business environment, efficient bookkeeping is pivotal for small businesses. Keeping accurate financial records can significantly impact a company's success. For small enterprises, leveraging the right bookkeeping solutions is crucial for informed financial decision-making.

Advertisement

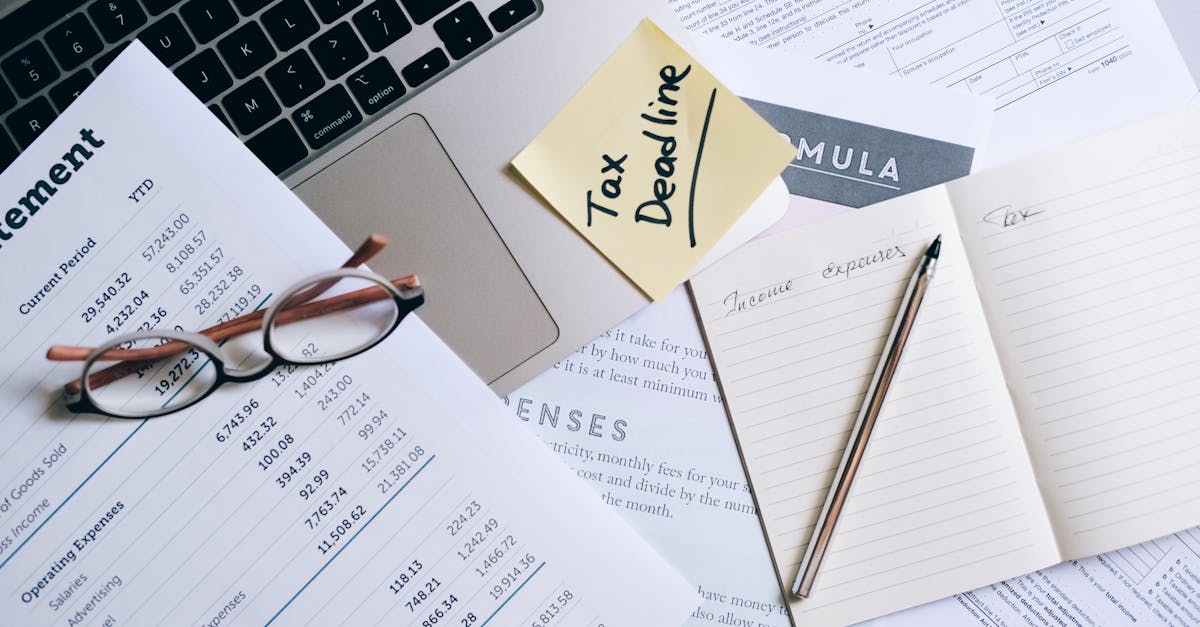

Understanding Bookkeeping Basics

Bookkeeping involves recording financial transactions that occur within a business. These records provide insights into cash flow, expenses, and profit. Accurate bookkeeping practices form the foundation for managing taxes, budgeting, and planning for growth.

Advertisement

Manual Bookkeeping Methods

Before the digital era, businesses relied solely on pen and paper to maintain records. Manual ledgers required diligent recording and regular updates. While this method can still be used, it's time-consuming and prone to human error, which can lead to financial discrepancies.

Advertisement

Digital Solutions and Accounting Software

With the advent of technology, digital bookkeeping solutions have gained popularity. Accounting software like QuickBooks, Xero, and FreshBooks helps small businesses automate their bookkeeping tasks. These tools offer features such as expense tracking, invoicing, and financial reporting, simplifying the bookkeeping process.

Advertisement

Cloud-Based Bookkeeping Advantages

Cloud-based bookkeeping solutions provide access to financial data anytime, anywhere. They allow real-time collaboration among team members and easy data sharing with accountants. Security features ensure data protection, making them a reliable choice for small businesses looking to safeguard their financial information.

Advertisement

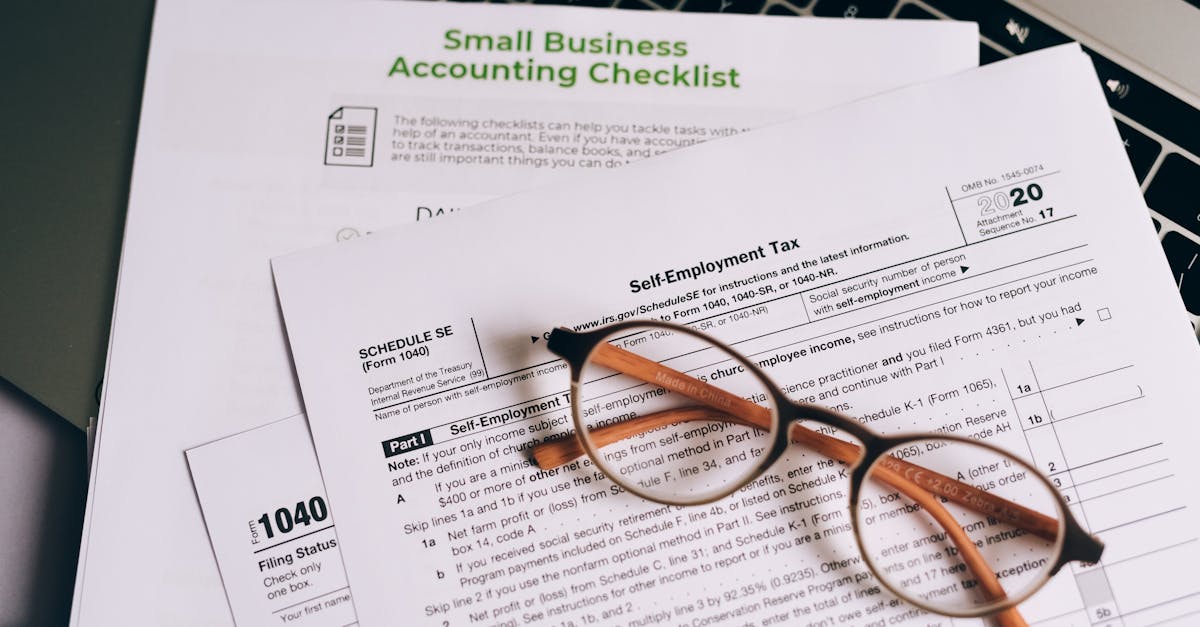

Outsourcing Bookkeeping Services

Some small businesses opt to outsource bookkeeping tasks to professional services. This approach ensures accuracy and allows entrepreneurs to focus on core business activities. Outsourced bookkeepers bring expertise and can handle complex financial tasks, acting as a valuable asset to small businesses.

Advertisement

Integration with Business Apps

Modern bookkeeping solutions often integrate with other business applications, such as CRM systems and inventory management tools. This interoperability streamlines processes, reducing manual data entry and minimizing the risk of errors, ultimately leading to more efficient operations.

Advertisement

DIY Bookkeeping Tools

For those who prefer managing their bookkeeping, DIY tools and mobile apps are available. These user-friendly platforms offer basic functionalities like expense logging and balance sheet generation. They cater to small businesses with straightforward financial needs and limited budgets.

Advertisement

Choosing the Right Solution

Selecting the right bookkeeping solution depends on specific business needs and budget constraints. It's vital to evaluate features, scalability, and user-friendliness. Consulting with a financial advisor can help small businesses choose a solution that aligns with their financial strategy.

Advertisement

Conclusion

In conclusion, small businesses have a plethora of bookkeeping solutions at their disposal. Whether opting for digital software, outsourcing, or DIY tools, choosing an appropriate approach ensures financial clarity. Emphasizing accurate bookkeeping practices can significantly contribute to a small business's long-term success.

Advertisement