Gold Versus Crypto Which Is The Better Investment

Introduction

Gold and cryptocurrency have emerged as popular investment options in the ever-evolving financial landscape. While gold has maintained a role as a stable store of value for centuries, cryptocurrencies represent the innovative frontier of investing. But which is the better investment for you? This article delves into the details of both options.

Advertisement

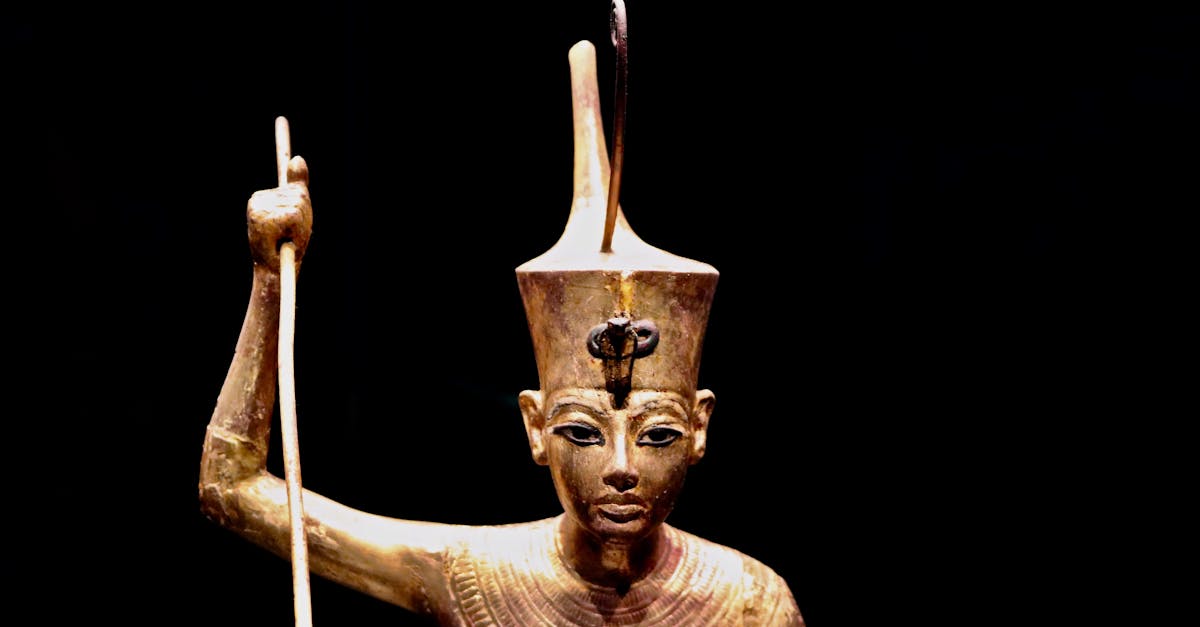

The Timeless Appeal of Gold

Gold has been synonymous with wealth and prestige for millennia, treasured across cultures for its rarity and beauty. It offers a sense of security, acting as a hedge against inflation and currency devaluation. In times of financial uncertainty, investors often flock to gold as a 'safe haven' owing to its tangibility and historical stability.

Advertisement

Cryptocurrency The New Frontier

Cryptocurrency, led by Bitcoin, has revolutionized the way we perceive and use money. Unlike gold, which is physically tangible, cryptocurrencies are purely digital and decentralized. This means they are not controlled by any central authority, offering transparency and cutting-edge technology in the financial world.

Advertisement

Market Volatility

While both gold and cryptocurrencies have displayed value fluctuations, the degree of volatility differs. Gold prices tend to be more stable and less susceptible to drastic market changes. In contrast, cryptocurrencies are known for their extreme price volatility, which can potentially offer higher rewards, but also comes with higher risks.

Advertisement

Liquidity and Accessibility

Gold boasts high liquidity, enabling quick conversion to cash when needed. However, storing physical gold involves logistical challenges and can incur storage costs. Cryptocurrencies, however, are easily accessible online and can be transferred with ease, providing a level of convenience that surpasses traditional gold holdings.

Advertisement

Regulatory Environment

Gold has long been embedded within the formal financial system, with well-established regulations. Cryptocurrencies, however, exist in a murky regulatory environment with ongoing debates on legal frameworks. Investors should consider these discrepancies, as regulation can impact market activities and profit potential.

Advertisement

Inflation Hedge and Growth Potential

Gold is traditionally seen as an excellent hedge against inflation, preserving purchasing power over time. Conversely, cryptocurrencies offer the potential for substantial growth due to their speculative nature and technological innovations, appealing to those seeking high returns despite higher risks.

Advertisement

Considerations for Investors

When deciding between gold and cryptocurrencies, investors should assess their risk tolerance, investment timelines, and financial goals. Diversifying portfolios to include both asset classes might be a strategic move, balancing the stability of gold with the growth potential of cryptocurrencies.

Advertisement

Comparing Past Performance

Historically, gold has demonstrated steady growth and sustained value. In the past decade, cryptocurrencies have skyrocketed in value, but have also exhibited dramatic downturns. Evaluating past performance can provide insights, yet neither guarantees future success.

Advertisement

Conclusion

Both gold and cryptocurrencies offer unique opportunities and challenges. Gold provides time-tested stability and wealth preservation, whereas cryptocurrencies invite innovation and potential for high returns. Ultimately, the better investment depends on individual preferences and market conditions, making careful research essential.

Advertisement