Top Auto Insurance for Seniors

Introduction

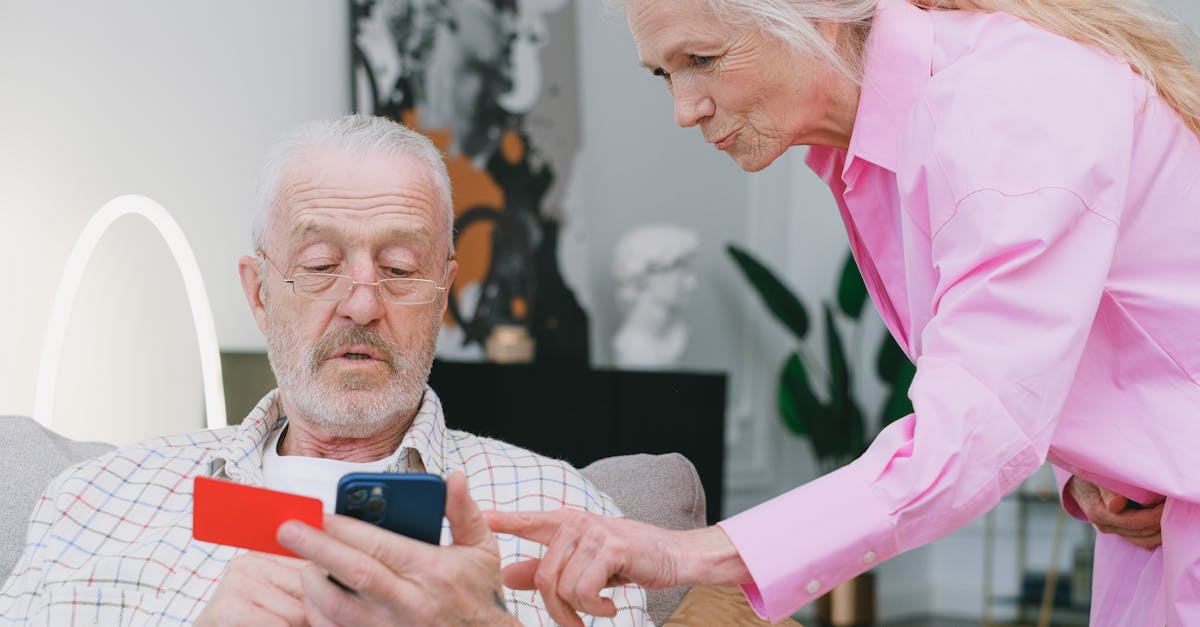

For senior citizens, finding the right auto insurance plan is crucial not only for peace of mind but also for financial security. Insurance companies often adjust their offerings based on driver experience, making various options available for seniors. This article provides an insightful guide to help seniors choose the best auto insurance that meets their unique needs.

Advertisement

Understanding Senior Needs

As people age, certain factors potentially affecting their auto insurance policies come into play. Seniors often have greater driving experience, which can lead to reduced premiums. However, factors like slower reaction times and potential health issues may lead insurance firms to adjust rates. Knowing these essentials helps in negotiating better terms for your insurance deal.

Advertisement

Discounts for Seniors

Many insurance companies offer specific discounts tailored exclusively for senior drivers. These often include deals for safe driving records, membership in certain organizations, and age-related reductions. It's wise to inquire directly with different insurers about the availability of such discounts, which can make a substantial difference in premium costs.

Advertisement

Comparing Insurance Providers

Not all insurance companies view senior drivers the same way. Therefore, shopping around is essential. Some notable insurers, like The Hartford through AARP, specialize in senior policies and may offer more competitive rates and tailored benefits. By comparing various offers from leading providers, seniors can secure coverage that best aligns with their needs.

Advertisement

Coverage Options to Consider

Seniors should carefully evaluate their coverage needs. Factors such as the type of vehicle, driving habits, and risk tolerance can influence the decision. Comprehensive coverage may be a priority for some, while others might value policies that offer roadside assistance or accident forgiveness. Understanding one's coverage needs ensures adequate protection on the road.

Advertisement

Safe Driving Courses

Some insurance companies incentivize safe driving courses for seniors. Completing these programs may not only boost driving confidence but can also result in insurance discounts. Insurers appreciate the commitment to safe driving, often translating this into reduced premiums for policyholders who have successfully completed such courses.

Advertisement

Bundling Policies for Savings

Bundling insurance policies, such as auto and home insurance, is a common practice to save on premiums. Many companies offer bundled discounts, helping seniors manage their personal finances more effectively. It's a practical strategy for those seeking comprehensive coverage from a single insurer.

Advertisement

Choosing High Deductibles

Opting for higher deductibles can drastically reduce monthly premium payments. Seniors who are confident in their safe driving skills might consider this approach, ensuring more manageable premiums while maintaining a safety net for substantial incidents. It’s crucial to assess one's financial capacity to pay a higher deductible out-of-pocket when needed.

Advertisement

Customer Service and Support

For seniors, user-friendly customer service can make navigating insurance policies less daunting. Look for insurers noted for their exceptional customer support, whether that means 24/7 assistance or a straightforward claims process. Empowered with this knowledge, seniors can make claims and inquiries with ease.

Advertisement

Summary and Conclusion

Finding the right auto insurance for seniors involves evaluating personal needs and potential discounts to secure the best deal. By considering different providers, coverage options, and bundling strategies, seniors can enjoy cost-effective, comprehensive protection. With informed choices, senior drivers can ensure financial security and peace of mind on the road.

Advertisement